Skilling Kerala

Powered by CSR Partnerships

Your Gateway to Impactful Giving

Your support is crucial in ensuring education for all!

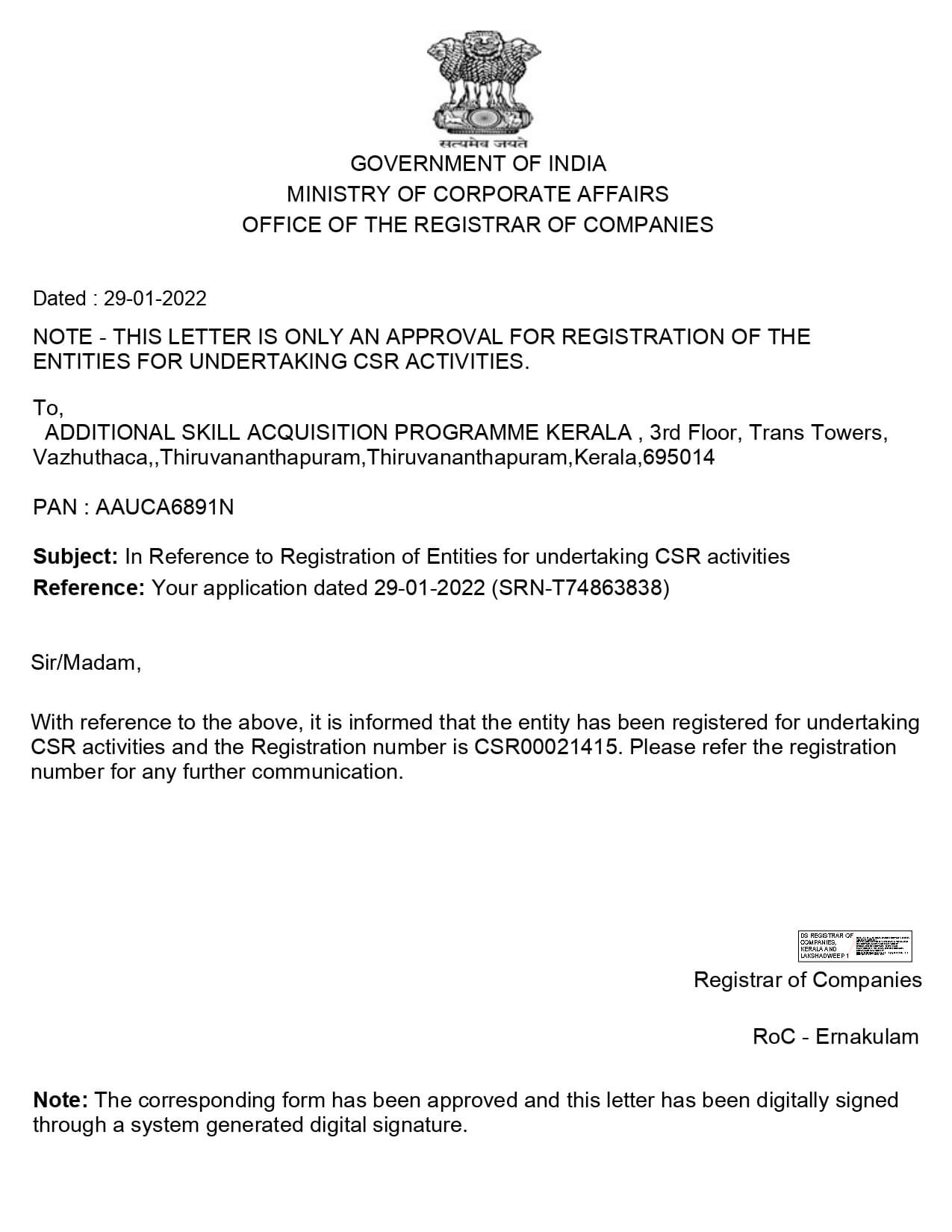

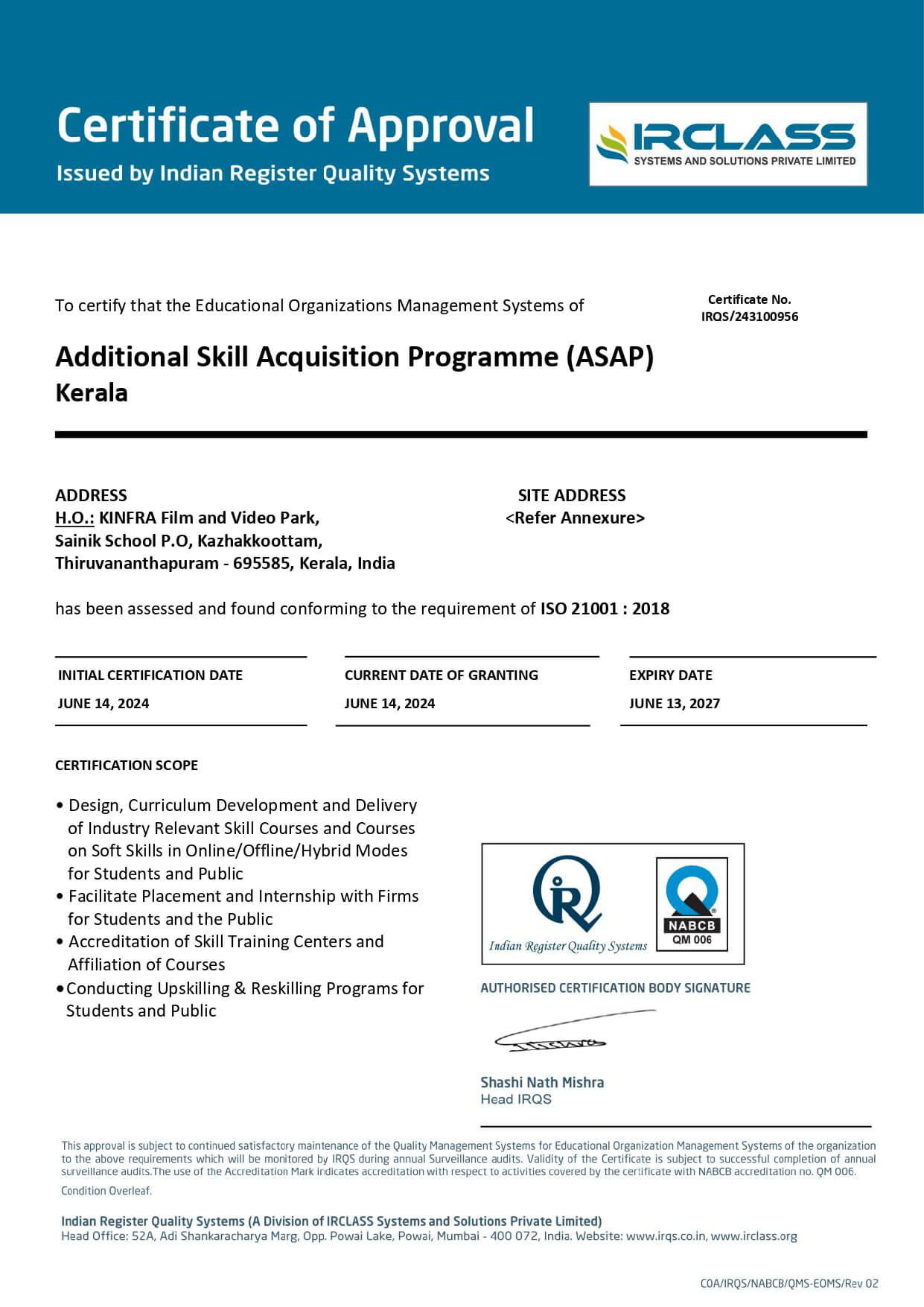

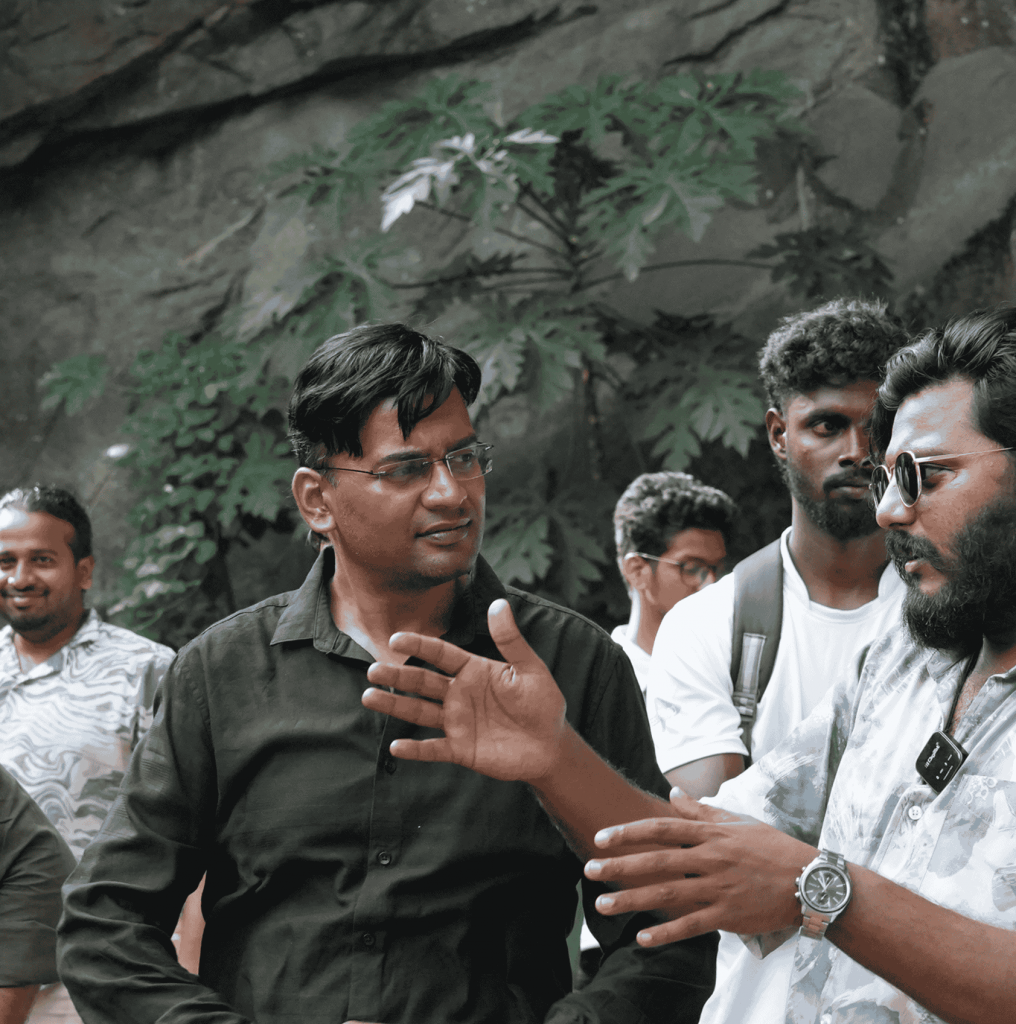

This vertical pools CSR and other funds from different private companies and government entities for the wholesome development Youth of Kerala in skilling.

Contribute financially to develop the skill infrastructure to augment the accessibility of the society to industry relevant skilling.

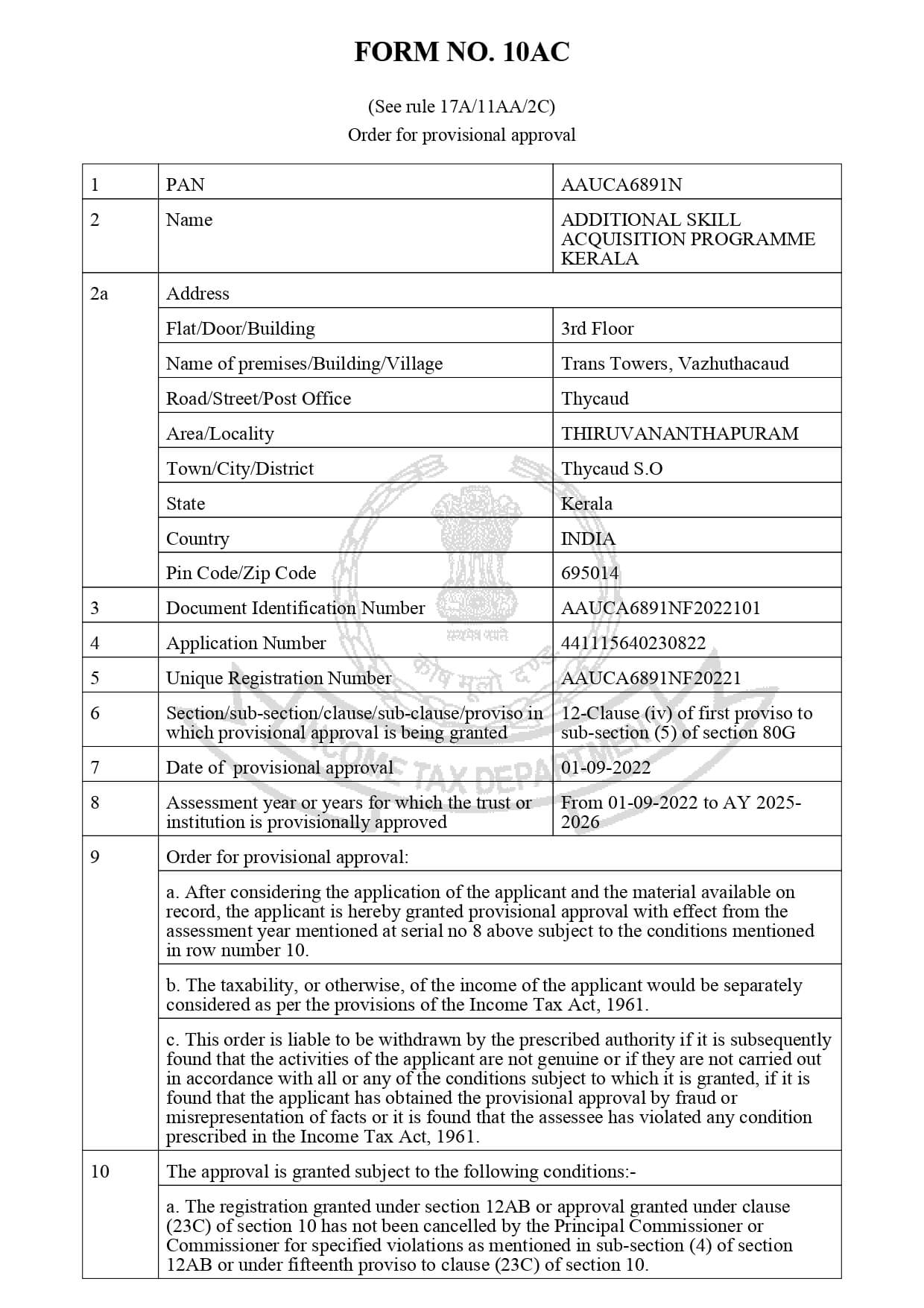

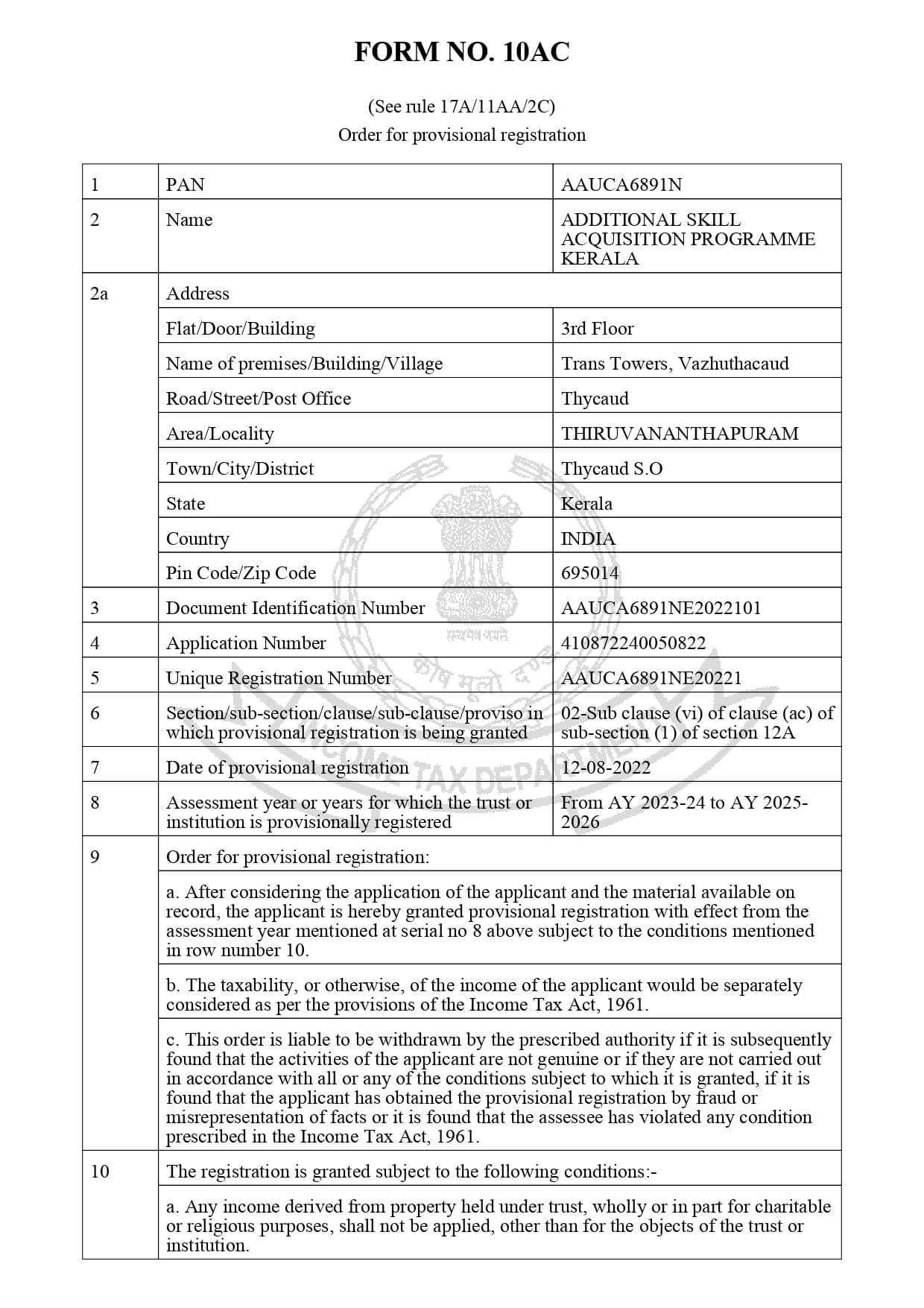

Our Certifications & Registrations

SUPPORT THE CAUSE

MAKE A DIFFERENCE

YOUR DONATION WILL HELP FOR THE SKILLING OF 1 STUDENT FOR 3 MONTHS

“YOUR CONTRIBUTIONS ARE ELIGIBLE FOR UPTO 50% TAX BENEFIT UNDER SECTION 80G AS ASAP KERALA IS REGISTERED AS NON PROFIT ORGANIZATION”.

Why Contribute

Skills are powerful tools that create and define an individual, ensure their growth, and create a market demand for oneself. In today’s rapidly changing industry environment, imparting industry-relevant skills is essential to ensure one’s survival.

India is enjoying a favourable demographic dividend, and skill development has become more important for the nation than ever before.

Contributing financially towards skill development can help us mould a future-ready and skilled talent pool that leads to employment and employment generation through entrepreneurship, igniting the dreams of thousands who are otherwise vulnerable and struggling to improve their standard of living.

Section 80G of the Income Tax Act, 1961, allows you to claim deductions on donations made to eligible organisations like ASAP Kerala. This means that you can reduce your taxable income by the amount you donate and make a visible change for the better. For more details, check out our FAQ.

Your contribution could change the life of a family by helping them acquire a valuable skill that can be channeled into employment.

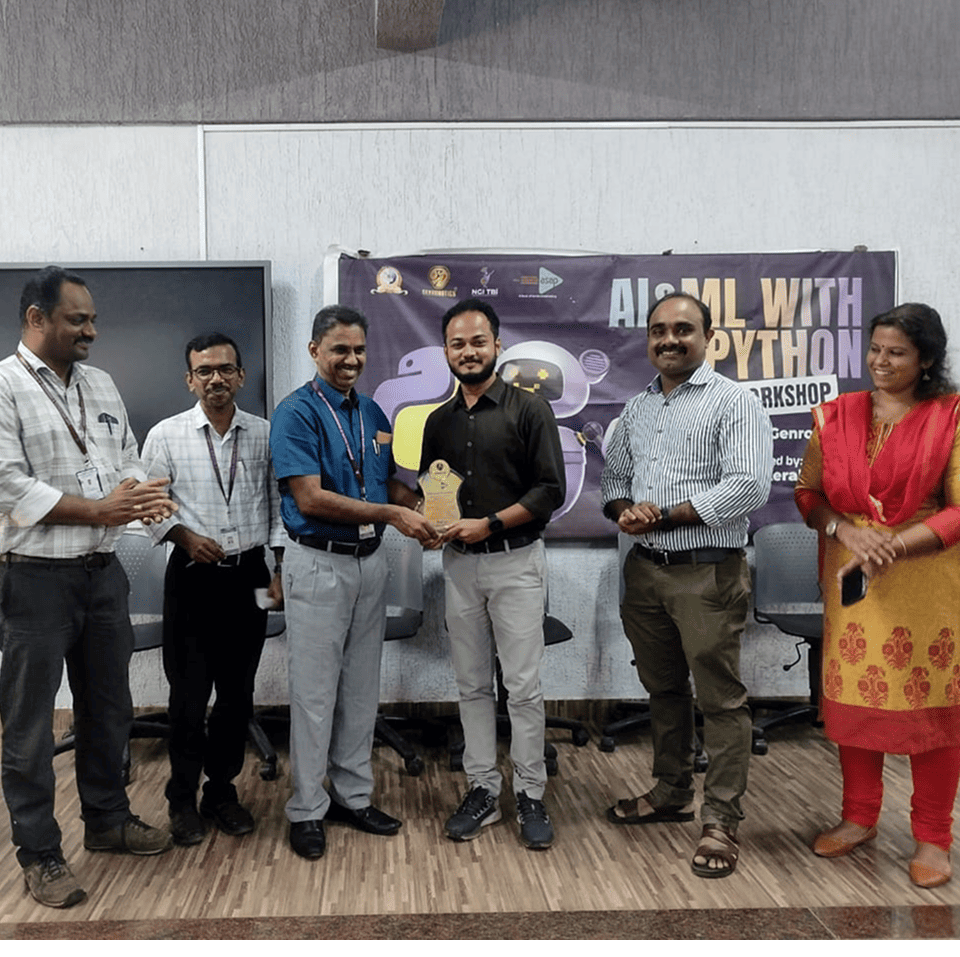

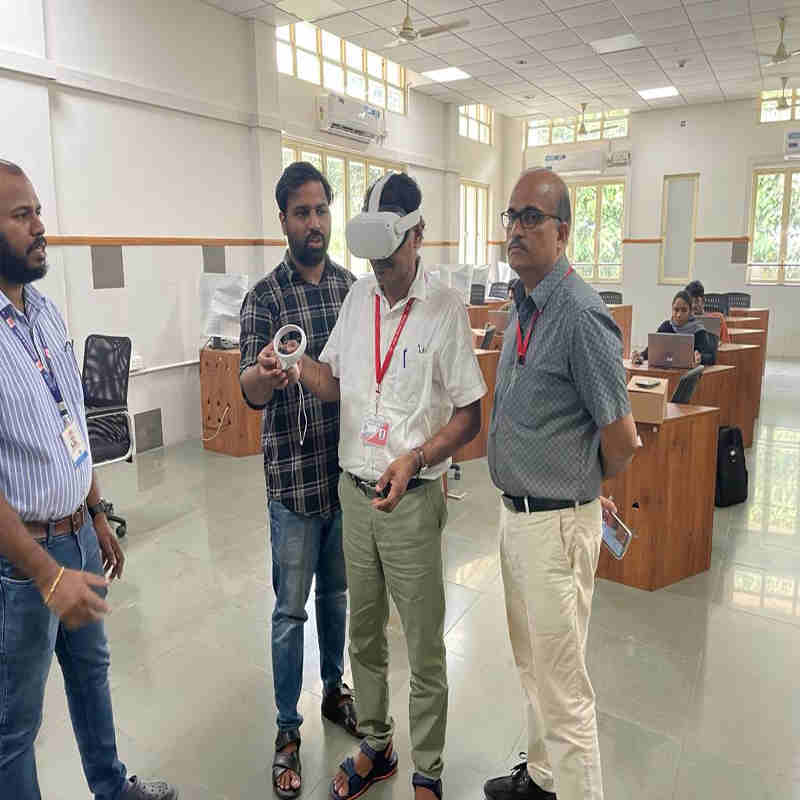

Media Center

FAQs

What is Section 80G of the Income Tax Act?

Section 80G of the Income Tax Act allows donors to claim tax deductions on donations made to eligible charitable institutions. ASAP Kerala has obtained 80G certification, enabling donors to claim a deduction of 50% or more on their donations, subject to certain limits and conditions.

What is Section 12A registration, and why is it important?

Section 12A registration under the Income Tax Act allows non-profit organizations to be exempted from paying income tax on their surplus income. This registration is crucial for ASAP Kerala as it ensures that all funds received are utilized for charitable purposes without tax liabilities, allowing the organization to maximize its impact.

How can I donate to ASAP Kerala?

You can donate to ASAP Kerala through our secure online donation platform on our website. We accept various modes of payment, including credit/debit cards, net banking, and UPI. All donations are eligible for tax benefits under Section 80G.

Are donations to ASAP Kerala tax-deductible?

Yes, donations made to ASAP Kerala are eligible for tax deductions under Section 80G of the Income Tax Act. Donors can claim a deduction of 50% or more of the donated amount, subject to the conditions and limits specified in the Act.

Will I receive a receipt for my donation?

Yes, after making a donation, you will receive an instant acknowledgment and an official receipt via email. This receipt can be used to claim tax deductions under Section 80G.

Contact Us

ADDITIONAL SKILL ACQUISITION PROGRAMME (ASAP) KERALA

CSR DIVISION

KINFRA Film & Video Park, Chanthavila

Sainik School P O, Kazhakoottam

Thiruvananthapuram – 695585

Kerala, India.

#donatetodevelop

#donatetoprosper